Кнопка «Шаблон» позволяет создавать на основе данной карточки другие. Кнопка «Подписаться» включает уведомления обо всех изменениях этой задачи. У бесплатной версии ограниченная функциональность, но её вполне хватает для управления небольшими проектами и командами. Платный доступ стоит 10 долларов в месяц за одного пользователя при оплате подписки на год. То есть управление небольшим отделом в десять человек в платной версии будет стоить 100 долларов в месяц. Одним из самых популярных сервисов управления проектами заслуженно считается Trello.

Он включает в себя настраиваемую систему цветных меток с режимом для дальтоников. Полный список горячих клавиш Trello доступен по ссылке. Как только мы заходим в сервис, сразу открывается главное меню. Присоединяйтесь более чем к двум миллионам команд по всему миру, которые уже используют Trello в работе. Для организаций, которые хотят обеспечить совместную работу команд и повысить уровень безопасности и контроля.

В WEEEK появился импорт данных из Trello по API и ряд важных обновлений

В карточке можно описывать задачу, которую необходимо выполнить. Когда вы приступаете к выполнению задачи, карточка переносится в колонку «В работе». А когда работы по ней завершены, то ее можно переносить в колонку «Готово». Обычно, внедрение https://deveducation.com/ Трелло в работу отдела или компании проходит легко и без лишних страданий. Но, все же, работа с новым приложением, тем более на постоянной основе, требует некоторой адаптации. Методология Kanban активно применяется не только в бизнесе.

- Для любой задачи можно назначить людей, ответственных за ее выполнение.

- Вы можете использовать его для включения всей информации, необходимой для завершения работы.

- Популярный среди команд инструмент повышения производительности плюс все возможности для безопасного масштабирования.

- Каждой команде нужно цифровое пространство, где можно без труда обмениваться идеями и проектной информацией, объединяя все разрозненные подразделения компании.

Для регистрации в Trello вам понадобится аккаунт в Atlassian. Главное удобство — не нужно создавать разные аккаунты для этих сервисов. Таким образом, аккаунт Atlassian похожа на аккаунт Google — вы авторизуетесь в одном аккаунте Gmail, например, и сразу входите в YouTube, Google Docs или Google Drive. Когда вы входите в Jira со своей учетной записью Atlassian, вы также можете войти в любой другой продукт Atlassian, такой как Trello, Bitbucket и другие. Для команд, которым необходимо отслеживать и визуализировать множество проектов несколькими способами, в том числе в виде доски, хронологии, календаря и т. [Trello] отлично подходит для упрощения сложных процессов.

Atlassian Together

Это позволит вам добавлять доски, списки и карточки для эффективного управления и отслеживания ваших задач и проектов, сохраняя при этом продуктивность. Trello помогает вам визуализировать все виды данных, включая то, что представляет собой проект, кто работает над какими задачами, каков прогресс отдельных участников и многое другое. Фрилансеры также могут использовать Trello в личных целях, например, для организации своих задач, управления сроками и установки напоминаний. В этом вам может помочь инструмент управления проектами или задачами, такой как Trello👍.

Расширенный контрольный список полезен для управления на микроуровне, тогда как настраиваемые поля позволяют создать четкую информационную иерархию. Эти функции помогают масштабировать операции, позволяя настраивать рабочий процесс. Вы можете использовать Trello на любом устройстве, будь то настольный компьютер или мобильное устройство, чтобы управлять своим бизнесом из любого места. Все данные хранятся на облачных серверах, а значит, ничего не может потеряться или забыться.

Bitbucket + Trello

Сосредоточьтесь на своей важной работе и позвольте Trello сделать все остальное с помощью автоматизации без кода — Батлер. Он встроен в Trello Board, чтобы упростить управление проектами и задачами. Вы можете создавать правила, команды и кнопки для автоматизации любых действий и задач. Итак, если вы ищете удобную платформу для своих проектов, Trello — это просто регистрация. Он предлагает интерактивный и визуально привлекательный👀 способ управления проектами и задачами, повышая при этом совместную работу и производительность команды.

Например, метками подсвечивают статус задачи или факт оплаты. Каждая доска содержит несколько списков и набор задач в виде карточек. Например, если интегрировать Trello с сайтом на Tilda, заявки из форм автоматически попадут на доски Trello.

Как можно настроить Trello под свои задачи

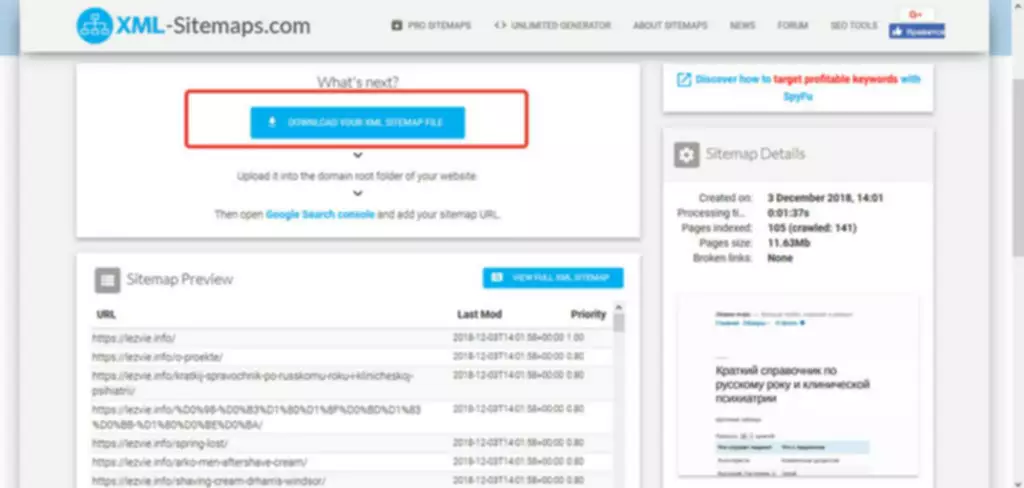

Чтобы настроить доску, в правом верхнем углу экрана нажмите «Меню». В планировании рекламной, маркетинговой или бизнес-стратегии участвуют руководители, директора, инвесторы. Чтобы уменьшить количество что такое трелло совещаний и встреч, перенесите стратегию на доску Trello. В этом случае в Trello распределяют задачи и контролируют, как работают менеджеры, маркетологи, рекламщики и остальные сотрудники.

Трелло — это простой в использовании облачный инструмент для совместной работы над любыми проектами, от свадебной вечеринки до бизнес-стратегии. Вы можете организовать свои проекты и задачи с помощью доски Trello. Trello — сервис для управления проектами и персональными задачами.

Особенности Трелло

Например, авторы, маркетологи, редакторы и верстальщики, которые вместе работают над ведением блога. Независимо от размера команды — 20 или 2000 участников — Trello будет развиваться вместе с ней, предлагая новые возможности на каждом этапе. С его помощью можно представить работу над несколькими проектами и инициативами в виде понятной и наглядной таблицы. Добавляйте участников в карточки, относящиеся к их проектам и заданиям, чтобы каждый понимал свою ответственность, и вы всегда знали, кто чем занимается. Единственным серьезным недостатком Trello можно назвать неудобство при реализации сложных и масштабных проектов. Хотя разработчики программы сделали многое, чтобы минимизировать подобные проблемы, например, добавили такие опции как комментарии, метки и т.д.

Списки можно перетаскивать по доске, изменять их порядок. То есть чтобы управлять кем-то или чем-то, руководитель создаёт команду, в ней — доски. Добавляет на доски участников в зависимости от того, кто над каким проектом работает. А потом просто заходит, смотрит на доску и сразу понимает, что вообще происходит и на каком этапе выполнения находится конкретная задача.